401k/IRA/TSP/403b Rollover

Annuities

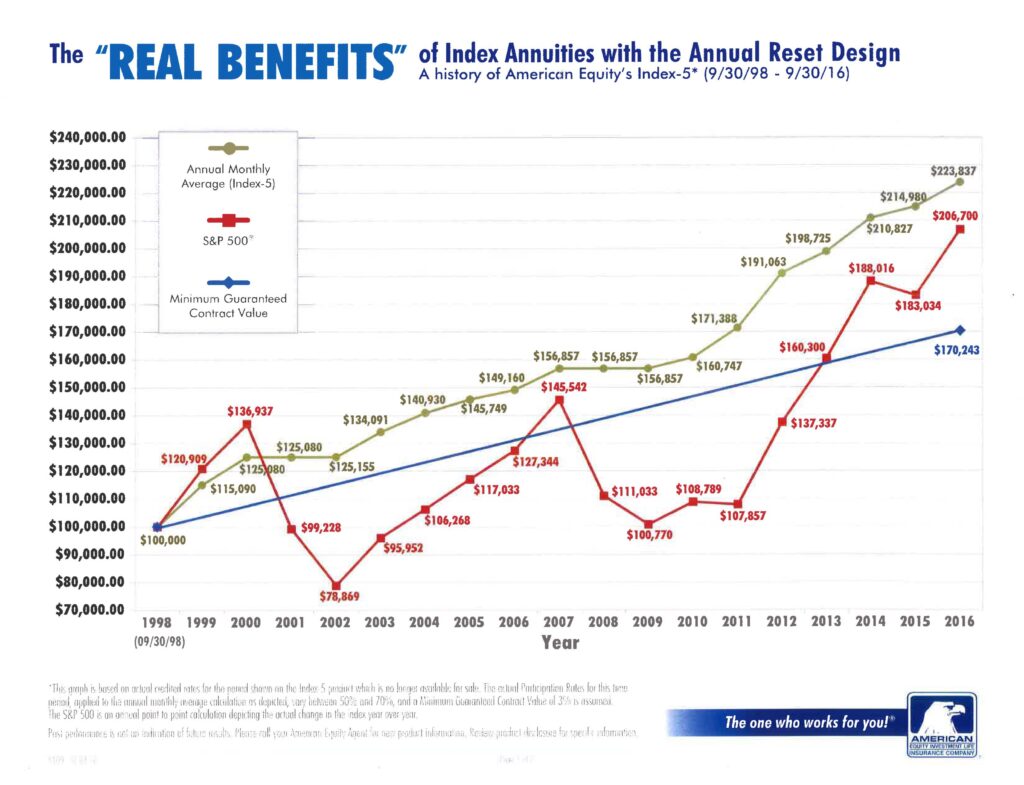

Annuities have become a very popular choice for 401k/IRA rollovers, and for those looking to secure guaranteed income that they cannot outlive. Annuities can help individuals save safely for retirement and earn interest linked to key stock market indexes, without the fear of stock market loss. In years where the market has gains, policyholders can get earn interest for the gains up to certain limits, or caps, but in years when the markets decline, policyholders will not experience any loss. This type of annuity is called a Fixed Index Annuity.

Types of Annuities

There are two basic types of Annuities: Fixed and Variable.

Fixed Annuities have the interest rate is a stated, pre-determined rate for a period of 3, 5 or 7 years

Fixed Index Annuity where the interest credits are linked to the returns of key stock market indexes, but can never be negative.

Both Fixed Annuities and Fixed Index Annuities provide guarantees that the account will never drop in value due to stock market loss.

Variable Annuities are a product of the insurance and the securities industry. Funds are invested in the stock and bond markets via professionally managed subaccounts. As such, policyholder funds are directly invested in the markets and values will fluctuate with market gains and losses. The full fee structures are buried in the product prospectus. I do not recommend Variable Annuities as they have high annual fees (3-5% of the account balance) and are exposed to stock market losses.

Common Annuity Myths

Myth 1: My Money Is Locked Away and Can’t Be Touched

With Fixed-Index annuities, you can withdraw money whenever you want. You can withdraw 10% of the account balance at any time without paying early withdrawal fees called surrender charges. Surrender charges decrease each year until the end of the surrender period, usually 7-10 years, at which time the surrender charges expire enabling you to access all of your funds without early withdrawal charges. Surrender charges are waived for death and certain health conditions such as confinement to a skilled nursing facility.

Myth 2: When I Die, the Insurance Company Keeps My Money

With the new Guaranteed Lifetime Income Riders (GLIR), clients no longer need to “annuitize” in order to receive income. The GLIR provides lifetime income that you cannot outlive even if you deplete the cash balance of the annuity. At death, any funds remaining in the annuity will be paid directly to your beneficiaries.

Myth 3: Annuities Are Expensive

Variable annuities can be very expensive with annual fees from 3-5%. However, Fixed-Index Annuities are usually ZERO fee products. With a Fixed-Index Annuity, all of your hard-earned savings will be working to generate growth guaranteed never to drop in value due to stock market losses.

Myth 4: Annuities Charge High Commissions

This may be true with Variable Annuities, but with Fixed-Indexed Annuities, agents are paid by the insurance company, not by you. 100% of your funds are working for you without one penny EVER being paid in agent commissions.